Does your company offer several types of IRA accounts? Are you unsure of your current IRA strategy? How do you know if the choices you make for your future are the best available to you?

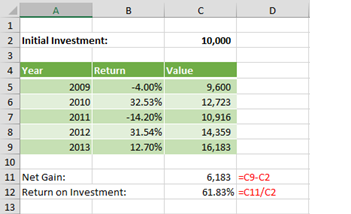

Say you review your IRA returns and consider changing your mix of investments. Five years ago, you invested $10,000 in a mutual fund that is now valued at $16,183. That’s a gain of over $6,000, but it took five years. Is that good?

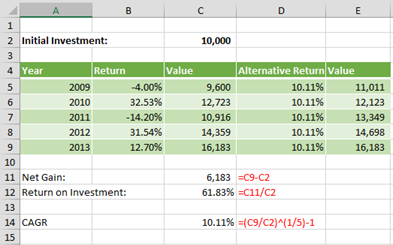

Now, another company advertises a fund with a five-year annualized growth rate of 12%. Surely it can’t mean that the fund earns 12% every year, for aren’t these investments iffy with frequent ups and downs? How can you compare your existing investment to the fund’s 12% five-year percentage?

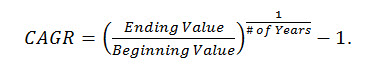

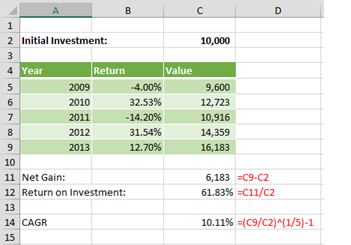

The good news is that you can do these calculations yourself, using Excel to find the Compound Annual Growth Rate, or CAGR, of your current investment.

An Example of Compound Growth

Compound growth means that, because your investment’s value gains a little bit each year (you hope!), you have more to invest in the following year. Consider this example:

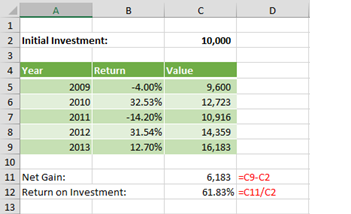

If you invested $10,000 at the beginning of 2009, you might have been concerned at the end of the year when your $10,000 had fallen to only $9,600, but you would have been elated a year later when it climbed to $12,723. By the end of five years, your $10,000 investment had grown to $16,183.

To calculate the net gain, simply subtract the initial value from the ending value. C9 – C2 = $6,183. This shows the absolute number of dollars gained, but it tells you nothing about the rate of return. Is this gain good? The answer is, “It depends.” Think of it this way: If you invested $75 and gained $6,183, you’d be thrilled; but if you invested several million dollars and had a gain of only $6,183, you’d fire your financial advisor. So is this return on an investment of $10,000 good?

Line 12 adds more information. The return on investment is the net gain divided by the initial investment. This is a 61.83% return. Generally speaking, a higher number is better, but it still doesn’t tell us anything about the timeframe.

The returns each year are volatile in this example, and simply averaging the values in Column B will not produce a useful metric.