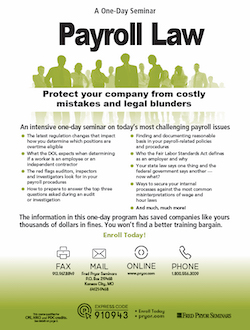

Master Payroll Law in Just One Day — Avoid Costly Mistakes and Stay Compliant

In one intensive, information-packed day, you'll dive into today’s most pressing payroll management challenges and get the knowledge you need to protect your organization. This comprehensive workshop will walk you through:

- Recent regulation updates that affect how you classify positions as “overtime eligible”

- What the Department of Labor looks for when determining employee vs. independent contractor status

- Payroll red flags that trigger audits, inspections and investigations

- How to confidently respond to the "Top 3 Questions" asked during an audit or review

- How to find and document a "reasonable basis" for your payroll-related policies and procedures

- Who qualifies as an “employer” under the Fair Labor Standards Act — and why it matters

- When state and federal laws conflict — and how to stay in compliance with both

- How to prevent misinterpretations of wage and hour laws that could leave your company vulnerable

- And much more!

This payroll management training is designed to help you interpret state and federal wage and hour laws with greater clarity — and, more importantly, understand how to keep your company off the DOL's radar. Everyone makes mistakes, but investigators are trained to find and correct them. We’ll help you prepare with a strong foundation of “good faith” efforts that can turn a costly audit or lawsuit into a learning opportunity instead of a legal disaster.

Payroll may seem straightforward — employees work, you calculate their pay, deduct taxes and issue checks. But what sounds like simple math quickly becomes complicated when you factor in Department of Labor wage and hour regulations around worker classification, overtime, minimum wage and what constitutes “hours worked.” Add IRS rules and the handling of “trust fund” monies, and it’s easy to step into a compliance minefield.

That’s where this payroll law seminar comes in.

You’ll walk away with practical strategies for processing payroll accurately, legally and confidently. We'll start with a crash course in payroll law fundamentals — identifying what’s governed at the state level, what’s federally regulated and where they overlap — so you can avoid the steep penalties of non-compliance.

What you don’t know can hurt you — but after this training, you’ll be prepared to protect your business.