Special Promotions

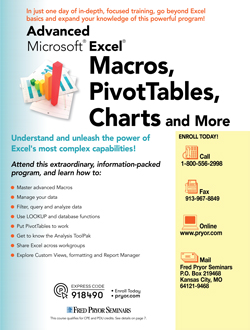

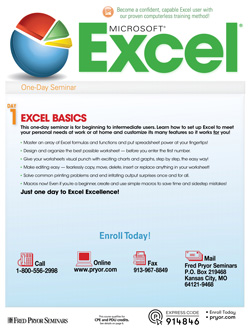

In-Person is Back In-Style

Have online fatigue? We also offer live in-person seminars in a city near you!

- Enjoy a day away from your computer learning new skills

- Learn from subject matter experts in real time

- Popular topics featuring management and leadership, human resources, communication, project management, personal development, business writing, Microsoft Excel and more

- PryorPlus members can attend these events $399 and under for free

OSHA 10- and 30-Hour On-Demand Training

Gain your OSHA card and stay compliant with engaging and convenient training in English and Spanish.

- OSHA 10-Hour General Industry

- OSHA 10-Hour Construction

- OSHA 30-Hour General Industry

- OSHA 30-Hour Construction