Why Take a Human Resource Seminar or Webinar?

The need for human resources training in today’s corporate world is more demanding than ever before. The role of HR teams to understand employment, leave and payroll laws while educating their organizations on workers’ comp, unconscious bias, diversity, sexual harassment, managing remote and hybrid teams and more cannot be over-emphasized. For both specialized and general HR professionals, having a human resources training center with a wide variety of courses available is essential to building a healthy workplace.

What Skills Does an HR Training Course Cover?

Being a successful part of the human resources team requires you to wear a variety of hats, and these requirements come with a variety of skills you need to be proficient.

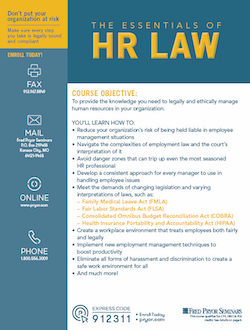

- Compliance and regulatory change

- FMLA compliance

- Payroll law

- HR law

- Writing effective policies

- And more

Identifying and overcoming HR challenges requires all the resources you can muster, and HR training online or in person is here to help.

Where to Start with HR Training Programs?

For most organizations, corporate culture begins with HR. In addition to serving as a gatekeeper for benefits, medical or bereavement leave, hiring/firing, onboarding/offboarding, recruiting and many other key staffing procedures, well-trained Human Resource roles are integral to the overall efficiency and productivity of every organization. Starting with HR classes from Pryor with online training and more means you can have access to a library of courses designed with your needs in mind.

Why Train with Pryor?

- Over 50 years in the learning and development industry

- Award-winning training for individuals and teams

- Learn online anywhere, anytime or at in-person events

- Professional credits and certifications

Types of Human Resources Training

- Live virtual seminars

- In-person events

- Live and on-demand webinars

- Downloadable products

- A component of your PryorPlus annual pass